-

Share

-

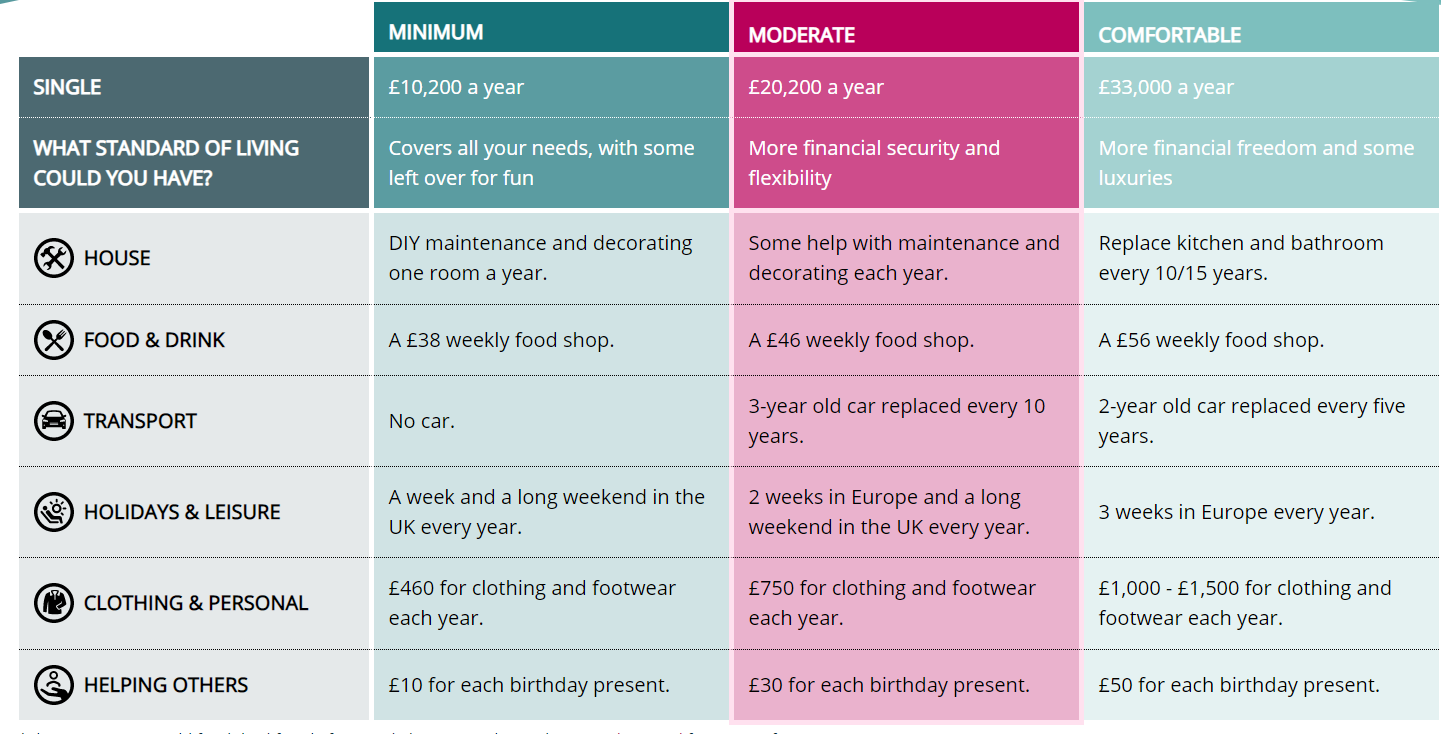

Perhaps the question is how much money do you want when you retire? This is such a personal question and whilst there are no wrong answers, many underestimate just how much is required.

Recent figures produced by the Pensions Lifetime and Savings Association and their “Retirement Standards” research, show what a single person might need per year in retirement to cover 3 different levels of standards of living; these are:

£10,000.00 for a minimum standard of living

£20,000.00 for a moderate standard of living

£30,000.00 for a comfortable standard of living

What do these numbers mean in real terms?

For many the State Pension has been their biggest source of retirement income, however the age at which you get this has moved from 65 to 66 in recent years and is expected to move to 68 by 2046.

Based on the current State Pension of £9,339.00 per annum, whilst going some way to achieving a minimum standard of living, additional savings will clearly be needed if you want to enjoy more than this and without saving, tough decisions will have to made as to what you would be prepared to give up and go without, in the supposed ‘golden years of your life’.

Perhaps you have dreams or goals set for this time in your life? It might be a worldwide cruise or to redesign the garden, and it may be that you would like to do this well before your State Pension is due.

With any private pension provision you have, you actually have the freedom to access these earlier than the State Pension Age (SPA), this date being anytime from age 55; however, the Government’s longer term plan is to align this so that it is 10 years before your designated SPA.

Are you prepared to bridge this gap to give yourself the option of enjoying an earlier retirement or even just work less at work, and use your private pension to supplement any reduction in your earnings?

How long have you got to save for your pension? Obviously, the sooner you start saving the better but you might be surprised how fast your pension pot can build up, and also just what the impact can be of delaying contributions in favour of having that extra night or that new pair of shoes!

Are you worried about your pension pot? Pension Bee quote that 16% of 41–54-year-olds feel they won’t be able to live comfortably. It’s never too late to start saving for retirement and equally it’s never too early. With so many things to consider can you afford not to review your pension pot?

Here at David Allen Financial Services we work with you to create a tailored solution aimed at helping you to achieve your personal retirement goals using cash flow retirement modelling tools that illustrate just what you need to put away to have that perfect retirement and give you that peace of mind.

For anyone signing up for a pension review during National Pension Week (13 – 17 September 2021) we will donate £100 to our chosen charity of the year Hospice at Home.