-

Related posts

-

David Allen IT Solutions expands operations to better serve growing client demand.

8 January 2025

-

Understanding Stamp Duty and Land and Buildings Transaction Tax

20 December 2024

-

How thoughtful giving can shape your children’s future?

10 December 2024

-

Understanding Cyber Security and why a layered approach is best

7 December 2024

-

Why you should use our team for Debt Recovery

3 December 2024

-

Stay safe this Black Friday and Cyber Monday with our cybersecurity tips for businesses and shoppers

29 November 2024

-

Are you confident your bills would be covered if an injury prevented you from working?

20 November 2024

-

What do the new National Insurance rules mean for employers?

31 October 2024

-

Why Private Medical Insurance could be a great option for you

6 October 2024

-

Representation in the industry: A female Financial Adviser’s perspective on roles within financial services

30 September 2024

-

David Allen IT Solutions are proud to be a Microsoft Surface Partner

13 September 2024

-

New research reveals worrying trends in late invoice payments, but David Allen Recovery Solutions can help

12 September 2024

-

New appointments and a promotion at David Allen Financial Services

1 August 2024

-

The King’s Speech Summary

19 July 2024

-

David Allen IT Solutions celebrates Cyber Essentials Plus renewal success

3 July 2024

-

What will happen to my money if there is a change in Government?

3 July 2024

-

Remortgaging – How David Allen Financial Services can help you

3 July 2024

-

Who would take care of your children if you passed away?

3 July 2024

-

Protect your business with effective Terms and Conditions

3 June 2024

-

BT PSTN Switch Off delayed to 31 January 2027

3 June 2024

-

David Allen IT Solutions Microsoft Partner for Modern Work

25 April 2024

-

The big PSTN Switch Off 2025

15 April 2024

-

Research and Development (R&D) tax relief changes from April 2024

15 April 2024

-

Realise HR achieves Cyber Essentials Certification with David Allen IT Solutions

28 March 2024

-

Navigating Debt During Debt Awareness Week 2024

18 March 2024

-

Prepare Your Business as Windows 10 End of Life Approaches

13 March 2024

-

‘Non-Dom’ tax rules – Spring Budget 2024

6 March 2024

-

Furnished Holiday Letting – Spring Budget 2024

6 March 2024

-

Business and Corporation Tax – Spring Budget 2024

6 March 2024

-

Pensions, Savings and Investments – Spring Budget 2024

6 March 2024

-

High Income Child Benefit Charge – Spring Budget 2024

6 March 2024

-

VAT and Duties – Spring Budget 2024

6 March 2024

-

National Insurance – Spring Budget 2024

6 March 2024

-

Income Tax – Spring Budget 2024

6 March 2024

-

Capital Gains Tax – Spring Budget 2024

6 March 2024

-

Inheritance Tax – Spring Budget 2024

6 March 2024

-

Smooth Transition: How migrating to David Allen IT Solutions assisted McMenon Engineering

29 February 2024

-

David Allen IT Solutions and David Allen Financial Services join forces with RAW Insurance to advise on your business’s Cyber Insurance

28 February 2024

-

Celebrating 20 Years: Alison Welton’s Remarkable Journey with David Allen

9 February 2024

-

Revolutionise Your Productivity with Microsoft Copilot for Microsoft 365 with David Allen IT Solutions

8 February 2024

-

Finding the Right Time to Outsource Your Payroll with David Allen

29 January 2024

-

Choosing the right protection when taking out insurance cover

17 January 2024

-

David Allen IT Solutions and Microsoft present ‘Securing your non profit making organisation using Microsoft 365’ Webinar

3 January 2024

-

Why ad-hoc IT Support may be costly for your business

3 January 2024

-

Have You Reviewed Your Cyber Security?

2 January 2024

-

Carole Donaldson celebrates 20 Years at David Allen

19 December 2023

-

Connor Fish: A Journey from Apprenticeship to IT Excellence at David Allen IT Solutions

13 December 2023

-

What happens if I do not have a Will?

12 December 2023

-

David Allen Recovery Solutions – Meet the team

7 December 2023

-

Money and divorce

29 November 2023

-

Changes to National Insurance Contributions for the Self Employed

28 November 2023

-

Free IT Review from David Allen IT Solutions

20 November 2023

-

Different scenarios to help illustrate the issues that can arise from an intestacy

14 November 2023

-

David Allen Financial Services can help you when applying for a mortgage

9 November 2023

-

David Allen Financial Services and NEST Insurance team up to streamline your home insurance experience

31 October 2023

-

Building a reliable income stream for your golden years

31 October 2023

-

Meet your specialist Wills, Lasting Power of Attorney and Probate team at David Allen

23 October 2023

-

Vicki Benson is celebrating 10 Years at David Allen

19 October 2023

-

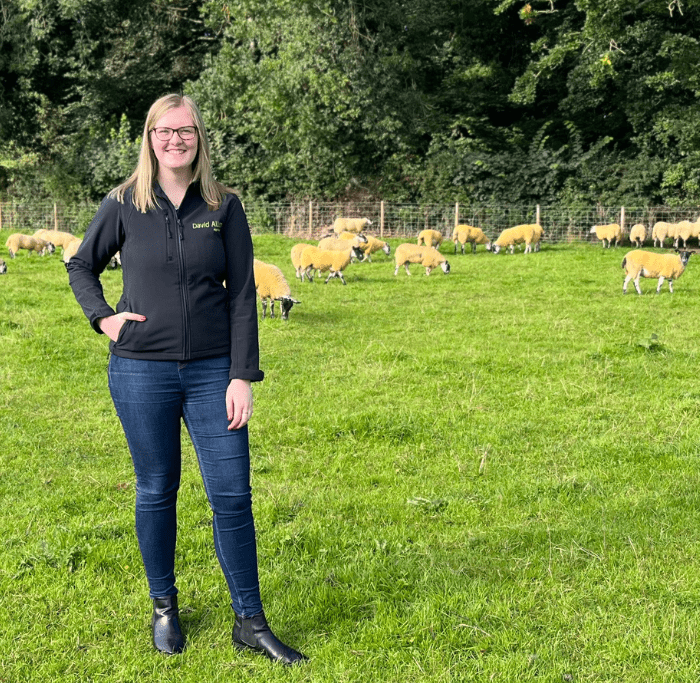

Katie Graham: From dairy farmer’s daughter to Agri Chartered Accountant with real world insights

16 October 2023

-

Alice Beattie: Where passion meets profession in just three days

25 September 2023

-

Holly Sproat: Returning to her roots

4 September 2023

-

Navigating Your Path to Homeownership with our Specialist Mortgage Team

25 August 2023

-

Associated Companies and Corporation Tax Explained

18 August 2023

-

The Stages of Debt Recovery

12 July 2023

-

Do you need to top up your National Insurance Credits?

7 July 2023

-

Amy Muirhead: An accountant with a Class 1 HGV licence, who would have thought?

5 July 2023

-

Farmyard Burdens – Michael Piele

4 July 2023

-

Guarantor Mortgages

28 June 2023

-

Navigating Windows Server 2012 End of Life: Your Options

28 June 2023

-

Early Bird Investors

22 June 2023

-

Are you worried about NHS waiting times?

14 June 2023

-

Changes to accounting year end dates

23 May 2023

-

New Appointment for David Allen Financial Services

12 May 2023

-

What is the Climate Change Levy?

2 May 2023

-

Careers Evening Success!

2 May 2023

-

State Pensions and Gaps in National Insurance

20 April 2023

-

Pensions Lifetime Allowance changes

20 April 2023

-

Upcoming tax changes for companies in 2023

20 April 2023

-

How much will my mortgage go up?

19 April 2023

-

Enforcement options following a County Court Judgement (CCJ)

4 April 2023

-

New VAT Penalties for Late Payment and Filing

23 March 2023

-

Cleaning up your finances this Spring

17 March 2023

-

Research and Development – Spring Budget 2023

15 March 2023

-

Pensions, Savings and Investments – Spring Budget 2023

15 March 2023

-

Energy Price Guarantee – Spring Budget 2023

15 March 2023

-

Business and Corporation Tax – Spring Budget 2023

15 March 2023

-

VAT and Duties – Spring Budget 2023

15 March 2023

-

Childcare, Universal Credits and Foster Care allowances – Spring Budget 2023

15 March 2023

-

National Insurance and National Minimum Wage – Spring Budget 2023

15 March 2023

-

Capital Gains Tax – Spring Budget 2023

15 March 2023

-

Income Tax – Spring Budget 2023

15 March 2023

-

Inheritance Tax – Spring Budget 2023

15 March 2023

-

National Minimum Wage Increase – 1 April

28 February 2023

-

Research and Development (R&D) Tax Relief

4 January 2023

-

Looking to upgrade your business’ IT?

3 January 2023

-

Cyber Essentials certification takes the risk out of risky business

20 December 2022

-

Joanna Seminara celebrates 10 years at David Allen

29 November 2022

-

Frequently asked questions when it comes to re-mortgaging your property.

17 November 2022

-

Our amazing Jaimi takes on Transiberica 2022

3 October 2022

-

Windows 11 – Is now the time to embrace Microsoft’s latest operating system?

3 October 2022

-

Can I deal with probate myself?

11 August 2022

-

Why save?

14 July 2022

-

What is an excepted estate?

13 July 2022

-

Award winning local IT support and services for South Cumbria

6 July 2022

-

Women and Finance

15 June 2022

-

Keeping Children Safe Online

15 June 2022

-

David Allen Recovery Solutions Team Set Sights High

14 June 2022

-

What interest can you charge on late payments?

10 June 2022

-

Farming and Finances

10 June 2022

-

Nurturing your future at David Allen

27 May 2022

-

Making Tax Digital for Income Tax – Will It Affect You?

25 May 2022

-

Research and Development (R & D) Tax Relief

25 May 2022

-

Our Expert Debt Recovery Team – Tracing Debtors

25 May 2022

-

Ensuring Our Children Are Financially Aware

20 May 2022

-

David Allen IT Solutions Sponsor The Falklands Commemorations

19 May 2022

-

What is a mortgage decision in principle?

4 May 2022

-

David Allen run for Calvert Trust

4 May 2022

-

What is Ethical Banking?

4 May 2022

-

I am an Executor of someone’s Will – what are my next steps?

28 April 2022

-

Award winning local IT support and services for the Eden District

27 April 2022

-

Top tips for self-builds

27 April 2022

-

Why use David Allen Recovery Solutions?

27 April 2022

-

Mileage allowance versus the rising cost of fuel

20 April 2022

-

Maximising Gift Aid to help your chosen charity

19 April 2022

-

Aspatria Rugby Union Club ‘amazed’ by David Allen Sponsorship

13 April 2022

-

Steve Balmer celebrates 10 years at David Allen

12 April 2022

-

The personal tax system – do you understand how it works?

11 April 2022

-

New Rate Changes

8 April 2022

-

A Head For Business – 25 Years of David Allen

7 April 2022

-

What is probate?

5 April 2022

-

Why remortgage?

1 April 2022

-

David Allen celebrates 25 year anniversary

1 April 2022

-

Spring cleaning your finances

17 March 2022

-

Stamp Duty Land Tax on Second Homes

15 March 2022

-

When can a Bounce Back Loan become a personal liability?

9 March 2022

-

Corporation Tax rates are increasing. Will this affect your company?

3 March 2022

-

Understanding your credit score

1 March 2022

-

Our Estate Administration Costs Calculator

1 March 2022

-

How are cryptocurrencies taxed in the UK?

1 March 2022

-

Should I be VAT registered?

24 February 2022

-

What happens when you don’t have a Will in place?

24 February 2022

-

Will you receive a full state pension?

23 February 2022

-

Award winning local IT support and services for South West Scotland and the Borders

18 February 2022

-

Year-end business tax planning – accelerating tax relief on asset purchases

14 February 2022

-

How long should you hold on to records?

10 February 2022

-

New Director for David Allen Financial Services

10 February 2022

-

Gifting Money

4 February 2022

-

Sharing, Spending, Saving

28 January 2022

-

New Year, New business?

19 January 2022

-

Our Charity of the Year partnership 2022

14 January 2022

-

ERNIE and your savings

14 January 2022

-

Our continued IT Solutions growth in West Cumbria

10 January 2022

-

Delivering big business IT to any size firm

4 January 2022

-

What changes can affect your Will?

4 January 2022

-

Child Trust Fund or Junior ISA – which is the best option?

4 January 2022

-

Pensions following the budget

8 December 2021

-

Tax Administration and Maintenance Day

2 December 2021

-

Making Tax Digital for Income Tax – Getting you ready

25 November 2021

-

Should you trade as a sole trader or limited company?

25 November 2021

-

When does a hobby become taxable?

16 November 2021

-

Talk Money Week – Mortgages

15 November 2021

-

Talk Money Week – Protection

15 November 2021

-

Talk Money Week – Junior ISA

15 November 2021

-

Talk Money Week – Savings and Investments

15 November 2021

-

Talk Money Week – Retirement

15 November 2021

-

Do you work from home?

9 November 2021

-

David Allen IT Solutions celebrates further expansion

4 November 2021

-

IT Solutions saves the day

2 November 2021

-

Tax relief brings Christmas cheer!

20 October 2021

-

Calling all homeowners!

14 October 2021

-

Why Save?

7 October 2021

-

Is Private Medical Insurance the way forward?

5 October 2021

-

The Government Kick Start Scheme and Traineeships

1 October 2021

-

Getting to know clients Peter and Carol Johnston, John Watt and Son

1 October 2021

-

How much does university cost? Should you be saving for your children’s future now?

24 September 2021

-

Chris Martin completes the gruelling ‘Fred Whitton’

24 September 2021

-

David Allen IT Solutions secure prestigious Microsoft Gold Partner status

23 September 2021

-

Lucy Metcalf celebrates ten years at David Allen

16 September 2021

-

Our Company Values

16 September 2021

-

Super-deduction tax break – what is it and how does it work?

16 September 2021

-

How much money will you need when you retire?

10 September 2021

-

“A job centered on death can be strangely life affirming” – Sarah Elsy, Trust and Estate Specialist

24 August 2021

-

Gary Martin – 30 Years in IT

6 August 2021

-

IT Consultant Neil Gilchrist joins David Allen IT Solutions

4 August 2021

-

Daniel Russell’s Exam Success

2 August 2021

-

Julie Taylor celebrates 15 years at David Allen

29 July 2021

-

Are you getting ready to claim the fifth SEISS grant?

20 July 2021

-

When a client gives feedback like this, we can’t help but share it

16 July 2021

-

Our Agricultural Partner, Michael Peile, celebrates 20 years at David Allen!

15 July 2021

-

Jaimi Wilson – One Hell of a Cyclist!

15 July 2021

-

New Accounts Apprentice joins David Allen Chartered Accountants, Dumfries.

12 July 2021

-

What do we mean by a ‘protection review’?

8 July 2021

-

Income protection…with a little something extra!

13 June 2021

-

To gift or not to gift?

4 May 2021

-

Help! My mortgage has gone on to my lender’s ‘standard variable rate’, what does this mean?

30 April 2021

-

Meet Donna Wilson, our mortgage and protection specialist

6 April 2021

-

Is your pension working hard enough for you?

24 March 2021

-

Removing the stigma surrounding Financial Advisers

10 March 2021

-

Financial Wellbeing and everything in between

2 March 2021

-

David Allen adds sixteen years’ experience to their financial services team in Dumfries

24 February 2021

-

How a great auditor can add value to your business

27 January 2021

-

Developing a career in auditing

10 December 2020

-

Tips for Cyber-Safe Christmas Shopping

7 December 2020

-

Dealing with a loved one’s last wishes – probate and why using David Allen makes sense

19 November 2020

-

The Big Switch Off 2025

3 November 2020

-

David Allen Financial Services collaborate with Watchtree Nature Reserve

29 October 2020

-

Contingent Charging and the value of advice (For Information Only)

29 September 2020

-

The benefits of outsourcing your payroll to a specialist

8 September 2020

-

The importance of using a mortgage broker

28 August 2020

-

The debt recovery team who go the extra mile

4 August 2020

-

How can we remove the stress that unpaid debt places on clients?

20 July 2020

-

Business as usual for David Allen

29 June 2020

-

How do you boost your Financial Wellbeing?

15 June 2020